September 16, 2021

The ASIFMA Compliance Week focused on various relevant topics for Compliance professionals, from culture and accountability to technology and innovation. Industry experts shared their insights during four days of sessions on regulatory enforcement trends, conduct, culture, the future of compliance, and market abuse.

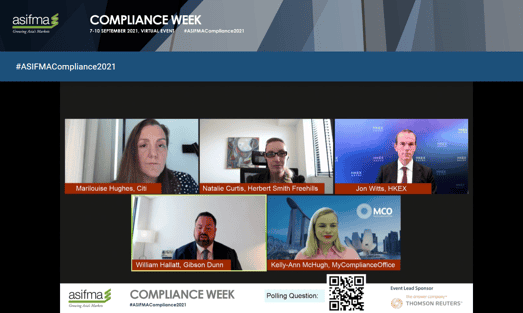

MyComplianceOffice was delighted to participate in this year's event and ASIFMA’s first virtual conference. Our Asia-Pacific director, Kelly-Ann McHugh, moderated a panel discussion on day 2 with the topic "Conduct Culture and Accountability Regime - Coordination across Different Countries".

A panel of experts joined Kelly-Ann during the discussion, including:

Between FINRA, BEAR, FAR, IAC, MIC, and SMCR, many regulations are hoping to improve conduct and culture in organisations. During the session, in a poll, attendees were asked 'How mature is your organisation’s approach to culture & accountability?'.

The results showed that most firms:

Panellists discussed that there is no one-size-fits-all formula to address culture and conduct issues in an organisation or a pre-made framework to be used to implement accountability regimes, especially because firms work in different jurisdictions and need to comply with local regimes in these countries.

While firms with different sizes must comply with the same rules and regulations, what they do internally to meet the standards might differ. It's important to remember that such regimes and a successful compliance program require continuous review, measurement, and assessment.

In addition to the different challenges faced in different regions, we have encountered the biggest challenge faced by Compliance teams, COVID-19, and the remote oversight of staff, which directly impacts culture and increases the risk of poor conduct.

Firms had to make a huge effort to operate during the COVID-19 pandemic. It provided a great way to demonstrate compliance culture due to the investment and training required to keep businesses running and staff protected and supported.

The experts provided a background of recent accountability regimes and shared an overview of how these regimes have improved. The panel talked about similarities and differences among accountability regimes in the US, Australia, New Zealand, Singapore, Hong Kong and in the UK and what firms and industries are doing to improve culture and accountability.

|

Americas |

Australia/New Zealand |

Asia |

Europe |

|

FINRA 1. Supervisory mapping/branch 2. Location mapping/branch |

1. Banking Executive Accountability Regime (BEAR) to evolve to Financial Accountability Regime (FAR) 2. CPS 520 Fit and Proper 3. ACL and AFSCL Responsible Managers, Directors and Company Secretaries |

1. Hong Kong: Manager in Charger (MIC) 2. Singapore: Individual Accountability and Conduct (IAC) |

1. UK: Senior Managers and Certification Regime (SMCR). Regulatory Reporting Lines 2. Ireland: Senior Executive Accountability Regime (SEAR) |

Then the panel talked about some vital points for firms to consider when implementing the Singapore Individual Accountability and Conduct Regime. The regulator suggests educating and guiding employees on what the regime is about and what it covers as a first step.

Employees need to know where their responsibilities fall and the implications if they fail to meet their obligations. Jon Witts, Head of Enforcement at the HKEX, added a few questions for firms to consider:

To conclude the session, the experts discussed practical ways to implement the various regulatory regimes, including reviewing the effectiveness of incentive systems, looking at the impact on individuals and understanding the feedback loop from external clients.