The Markets in Crypto-Assets Regulation (MiCA) institutes uniform regulations for crypto-assets across the EU that are not currently regulated by existing financial services legislation. The Application of Rules for asset-referenced and e-money tokens took effect on 30 June 2024 and the Application of Rules for the remaining asset classes in took effect in December 2024.

MiCA is expected to come into force in 2024. Key milestones include:

20 April 2023 - EU Parliament approval

20 April 2023 - EU Parliament approval Read how Europe and the UK are at the forefront of Crypto Regulation

"The Commission is of the view that, where crypto-assets are not covered by EU financial regulation, the absence of applicable rules to services related to such assets leaves consumers and investors exposed to substantial risks. In addition, the fact that some Member States have put in place bespoke rules at national level for crypto-assets that fall outside current EU regulation, leads to regulatory fragmentation, which distorts competition in the Single Market, makes it more difficult for crypto-asset service providers to scale up their activities cross-border and gives rise to regulatory arbitrage. Lastly, the crypto asset subset of 'stablecoins' can raise additional challenges if it becomes widely adopted by consumers."

—Europe Fit for the Digital Age, European Parliament Legislative Train 06.2023

According to Mark Browne, Partner at Clerkin Lynch LLP, MiCA came about because of the lack of legislative clarity in the EU market. Do tokens fall under existing legislation, including MiFID, the Electronic Money Directive, or the Payment Services Directive? It's subject to interpretation and very unclear.

The potential for conflicting regulations at the national level confused the situation even further. The lack of clear and specific regulation diminished consumer protection and could discourage regulated businesses from pursuing opportunities in the region.

"Any legislative act adopted in the field of crypto-assets should be specific and future-proof, be able to keep pace with innovation and technological developments and be founded on an incentive-based approach. The terms ‘crypto-assets’ and ‘distributed ledger technology’ should therefore be defined as widely as possible to capture all types of crypto-assets that currently fall outside the scope of Union legislative acts on financial services."

—Regulation (EU) 2023/1114 on markets in crypto-assets

MiCA will implement a cohesive legislative framework for Crypto-Assets that applies to all relevant issuers and service providers within the EU. Mark notes that there are two competing imperatives with the legislation. The legislation must be broad enough to adapt to change as the industry develops and, at the same time, specific enough to ensure regulatory and legal certainty.

The MiCA legislation classifies regulated crypto-assets into three categories, which should be distinguished from one another and subject to different requirements depending on the risks they entail:

Of equal note is what is not covered under MiCA. As outlined in Article 2 of the legislation, there's a long list that's outside the parameters of MiCA, including Non-Fungible Tokens (NFTs), Central Bank Digital Currencies, Financial instruments as defined under MiFDII, the European Investment Bank and its subsidiaries, deposits, including structured deposits, and funds, except if they qualify as e-money tokens.

Mark thinks there is still potential for confusion and overlap between what is covered under MiCA and what is not, and expects that additional guidance will be forthcoming. To hear more from Mark, watch the on-demand webinar Markets in Crypto Assests (MiCA) Regulation Explained.

"Crypto-asset means a digital representation of a value or of a right that is able to be transferred and stored electronically using distributed ledger technology or similar technology.”

—Regulation (EU) 2023/1114 on markets in crypto-assets

The MiCA regulation is broad and contains many defined terms cross-referenced throughout the legislation. According to Mark, the place to start to understand the legislation is with the taxonomy of terms contained in the document. Not all in the financial services or legal world might be familiar with these terms, or given the lack of clarity around crypto-assets, there might not have been a shared understanding across the industry about what they mean.

Mark divides the definitions into five categories: Token definitions, technology definitions, participant definitions, activity definitions and legal definitions. A complete list of the definitions applied in the legislation can be found in Article 3 of the MiCA legislation. And for an explanation of key terms, watch the on-demand webinar Markets in Crypto-Assets (MiCA) Regulation Explained.

The MiCA legislation contains critical provisions for those issuing and trading crypto-assets (including asset-reference tokens and e-money tokens) covering transparency, disclosure, authorisation and supervision of transactions.

The legislation regulates tokens and Crypto-Asset Service Providers (CASPs). It requires both issuers of Crypto-Assets and CASPS to implement Consumer Protection safeguards, including prudent governance and risk management policies, disclosure of potential conflicts of interest, and acting in the client's best interest. Safeguards are also required to prevent Market Abuse, including market manipulation, insider trading, wash trading, and ESG disclosures.

Read our white paper on Market Abuse in the Digital Age

Article 111 of the MiCA legislation outlines the potential penalties for infringement and failure to comply with the provisions, including fines, public statements, cease and desist orders, personnel bans and suspension.

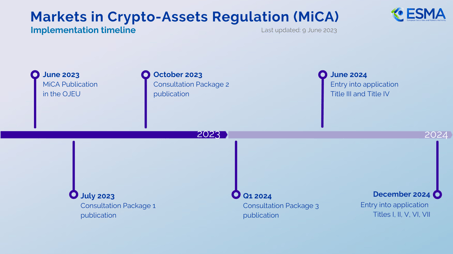

The first Consultation Package regarding the regulation was published on 12 July and requested feedback on rules for crypto-asset service providers regarding authorisation, identification, management of conflicts of interest, and complaints. The second Consultation Package was published on 5 October and requested feedback on sustainability indicators for distributed ledger technology, disclosures of inside information, technical requirements for white papers, trade transparency measures, and record-keeping standards for crypto-asset service providers. The third Consultation Package solicits feedback on the role of crypto service providers based outside of the EU by 29 April.

During the implementation phase of MiCA, ESMA is seeking public feedback on technical standards via three consultation packages. Consultation Package 1 was released on 12 July 2023, seeking opinions regarding authorisation, identification, management of conflicts of interest and complaints. In particular, ESMA invites crypto-assets issuers, crypto-asset service providers and financial entities dealing with crypto-assets to provide comments by 20 September.

In addition, ESMA aims to gather insight into respondents’ current and planned activities regarding expected turnover, the number of white papers they plan to publish and the use of on-chain vs off-chain trading. The input to this part of the consultation will remain confidential and will serve to calibrate proposals to be included in the second and third consultation packages.

In the release, ESMA Chair Verena Ross also reminded consumers that regulation or not, crypto investments still carry risk, noting, "We also want to remind consumers that, even with the implementation of MiCA, there will be no such thing as a safe crypto-asset.”

Consultation Package 2 was released on 5 October 2023. ESMA is seeking input on five sets of proposed rules by 14 December, including:

Article 87 of MiCA defines insider information as" information of a precise nature which has not been made public, relating, directly or indirectly, to one or more issuers, offerors or persons seeking admission to trading, or to one or more crypto-assets, and which, if made public, would have a significant effect on the prices of the relevant or related crypto assets.”

MiCA lays out rules to deter market abuse concerning the trading of crypto assets. As part of these rules, the legislation prohibits insider dealing, unlawful disclosure of inside information, and market manipulation and includes an obligation to publicly disclose inside information.

Article 88 of MiCA also requires issuers, offerors or persons seeking admission to trading to inform the public as soon as possible of inside information that directly concerns them in a complete and timely manner. The section also provides that the relevant parties post and maintain on their website, for a period of at least five years, all inside information that they are required to publicly disclose.

Under Article 61(3) of MiCA, ESMA issued guidelines to specify the situations in which a third-country firm can solicit EU clients along with supervision practices to detect and prevent circumvention of the reverse solicitation exemption.

Third-country firms are companies incorporated outside the EU seeking to conduct business through either a branch established in the EU or on a cross-border basis. The provision of crypto-asset services by third-country firms is strictly limited under MiCA to cases where a client initiates the service. This exemption is known as the reverse solicitation exemption. The consultation paper reinforces that the reverse solicitation exemption is narrowly framed and should be regarded as the exception to the rule. Use of the reverse solicitation exemption cannot be assumed, nor should it be exploited to circumvent MiCA regulations.

The Consultation Package published on 29 January contains additional guidance on the conditions surrounding the application of the reverse solicitation exemption and supervision practices that regulators may take to prevent circumvention of the standards. The guidance also outlines expectations for compliance and reporting requirements.

ESMA invited all interested stakeholders to respond to this consultation paper by 29 April 2024, particularly crypto-asset service providers (including from outside the EU) and financial entities dealing specifically with crypto-assets.

On 31 May 2024 ESMA published the Final Report on certain requirements regarding conflicts of interests for crypto-asset service providers. The report outlined requirements for policies and procedures around the identification, prevention, management and disclosure of conflicts of interest along with details and methodology for conflicts of interest disclosures.

Crypto providers must implement and maintain effective policies and procedures to identify, prevent, manage and disclose conflicts of interests between themselves and parties including:

The report also mandates that the general nature and sources of conflicts of interest along with the steps to mitigate them are disclosed to clients and prospective clients by posting them on a prominent place on the firm's website.

We can help you be ready for the many provisions of MiCA. To meet with our team to see how MCO is helping firms manage conflicts of interest, insider information and prepare for crypto-asset compliance, click here to set up some time for a demo.